IFRS IGAAP USGAAP

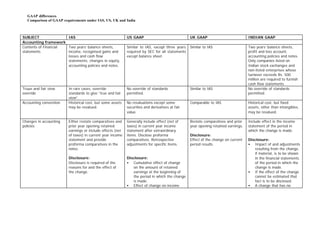

- 1. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP Accounting framework Contents of Financial Two years’ balance sheets, Similar to IAS, except three years Similar to IAS Two years’ balance sheets, statements income, recognised gains and required by SEC for all statements profit and loss account, losses and cash flow except balance sheet. accounting policies and notes. statements, changes in equity, Only companies listed on accounting policies and notes. Indian stock exchanges and non-listed enterprises whose turnover exceeds Rs. 500 million are required to furnish cash flow statements. Truue and fair view In rare cases, override No override of standards Similar to IAS No override of standards override standards to give “true and fair permitted. permitted. view”. Accounting convention Historical cost, but some assets No revaluations except some Comparable to IAS Historical cost, but fixed may be revalued. securities and derivatives at fair assets, other than intangibles, value. may be revalued. Changes in accounting Either restate comparatives and Generally include effect (net of Restate comparatives and prior Include effect in the income policies prior year opening retained taxes) in current year income year opening retained earnings. statement of the period in earnings or include effects (net statement after extraordinary which the change is made. of taxes) in current year income items. Disclose proforma Disclosure: statement and provide comparatives. Retrospective Effect of the change on current Disclosure: proforma comparatives in the adjustments for specific items. period results. • Impact of and adjustments notes. resulting from the change, if material, is to be shown Disclosure: Disclosure: in the financial statements Disclosure is required of the • Cumulative effect of change of the period in which the reasons for and the effect of on the amount of retained change is made. the change. earnings at the beginning of • If the effect of the change the period in which the change cannot be estimated that is made. fact is to be disclosed. • Effect of change on income • A change that has no

- 2. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP before extraordinary items and material effect in the on net income (and related per current period but is share amounts). reasonably expected to • Income before extraordinary have material effect in items and net income later periods is to be computed on pro forma basis appropriately disclosed in on the face of the income the period in which change statement for all periods is adopted. presented as if the new policy had been applied during all periods. Correction of Either restate comparatives or Restate comparatives. Similar to US GAAP Include effect in current year fundamental errors include effect in current year Adjustments required to be made income statement. income statement with to previously issued financial proforma comparatives in the statements. notes. Reporting currency Requires measurement of profit Uses a functional currency. Does In practice it is rare for entities In practice it is rare for entities using the measurement not specify the concept of a not to use sterling. not to use local currency. currency, however entities may presentation currency. present financial statements in different currency. Balance sheet format Does not prescribe a particular Similar to IAS, items presented on Company law specifies various Company law specifies various format, however certain items the face of the balance sheet are formats. Items presented are formats. must be presented on the face generally presented in decreasing similar to IAS, except of the balance sheet. order of liquidity. shareholders’ funds are required to be analysed into equity and non-equity elements. Income statement Does not prescribe a particular Present as either a single step or Company law specifies four Does not prescribe a particular format format, however expenditure multiple step format. Expenditure alternative formats. format, however prescribes must be presented in one of must be presented by function. certain disclosure norms for

- 3. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP two formats (function or income and expenditures. nature). Certain items must be presented on the face of the income statement. Cash flow statement - Standard headings, but Similar headings to IAS, but more More standard headings than Standard headings, using formats and method flexibility over their contents. specific guidance given for items IAS. Use direct or indirect direct or indirect method, Use direct or indirect method. to include in each. Use direct or method. prescribed for all listed indirect method. companies and companies with turnover in excess of Rs 500 million. Cash flow statements - Cash includes overdrafts and Cash excludes overdrafts but Cash includes overdrafts but Cash includes cash in hand definition of cash and cash equivalents with short- includes cash equivalents with excludes cash equivalents. and deposits repayable on cash equivalents term maturities (less than 3 short-term maturities. demand. Cash equivalents are months). short term, highly liquid investments that are readily convertible to cash (normally 3 months or less). Bank borrowings are generally considered to be financing activities. Changes in accounting Account for in income Similar to IAS. Similar to IAS Comparable to IAS. estimates statement in the current and future periods, as appropriate. Group Reporting Definition of subsidiary Based on voting control or Controlling interest through Similar to IAS Controlling interest through power to exercise dominant majority ownership of voting majority of voting shares or influence. shares. Recent proposals similar to control of board of directors. IAS. Exclusion of subsidiaries Only if severe long-term Comparable to IAS. Similar to IAS Comparable to IAS. from consolidation restrictions or acquired and • If control is likely to be held for re-sale in the near temporary or if it does not rest

- 4. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP future; dissimilar activities is with the majority owner. not a justification. • Significant doubts as to the parent’s ability to control. Definition of associate Based on significant influence: Broadly comparable to IAS. Requires evidence of exercise An associate is an enterprise in presumed if 20% interest or of significant influence which the investor has participation in entity’s affairs. significant influence and which is neither a subsidiary nor a joint venture of the investor. Significant influence is the power to participate in the financial and/or operating policy decisions of the investee but not control over those policies. As regards share ownership, if an investor holds, directly or indirectly through subsidiary(ies), 20% or more of the voting power of the investee, it is presumed that the investor has significant influence, unless it can be clearly demonstrated that this is not the case. Conversely, if the investor holds, directly or indirectly through subsidiary(ies), less than 20% of the voting power of the investee, it is presumed that the investor does not have significant influence, unless such influence can be clearly

- 5. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP demonstrated. Presentation of associate Use equity method. Show share Use equity method. Show share of Use expanded equity method. Use equity method. Show results of profits and losses. post-tax result. Share of operating profit, share of profits and losses. exceptional items and tax The equity method is a method shown separately. of accounting whereby the investment is initially recorded at cost, identifying any goodwill/capital reserve arising at the time of acquisition. The carrying amount of the investment is adjusted thereafter for the post acquisition change in the investor’s share of net assets of the investee. The consolidated statement of profit and loss reflects the investor’s share of the results of operations of the investee. Disclosures about Following disclosures to be Give detailed information on Similar to US GAAP. Following disclosures to be significant associates made: significant associates’ assets, made in Consolidated Financial • List and description of liabilities and results. statements: Associates including • Reasons for not applying proportion of ownership the equity method of and proportion of voting accounting for investments power (if different from in associates. proportion of ownership) • Goodwill/Capital reserve • Method used to account for arising on acquisition of an such investments. associate. (included in • Investments in associates carrying amount but

- 6. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP accounted for using the disclosed separately) equity method classified as • List and description of long-term investments Associates including • The investor’s share of the proportion of ownership profits or losses of such and proportion of voting investments. power (if different from • The investor’s share of any proportion of ownership) extraordinary or prior • Investments in associates period items. accounted for using the equity method classified as long-term investments • The investor’s share of the profits or losses of such investments. • The investor’s share of any extraordinary or prior period items. • Names of associates whose reporting dates are different from those of the investor’s financial statements together with the difference in the reporting dates. • The fact that it is impracticable to make adjustments to the associate’s financial statements for differences between accounting policies of the associate and those used for consolidated financial

- 7. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP statements together with a brief description of the differences. Equity method or Both proportional consolidation Generally use equity method. Use Generally use gross equity Three forms of Joint Ventures proportional and equity method permitted. proportional consolidation in method. identified: consolidation for joint Consolidate own assets / limited circumstances, such as oil Consolidate own assets / 1. Jointly controlled ventures liabilities in limited and gas ventures. liabilities in limited operation: Venturer to circumstances such as oil and circumstances such as oil and recognize in its separate gas ventures. gas ventures. financial statements • assets it controls • liabilities it incurs • its share of income • expenses it incurs 2. Jointly controlled assets: Venturer to recognize in its separate financial statements • Share of jointly controlled assets • Liabilities it has incurred • Share of jointly incurred liabilities • Share of income and expenses from the joint venture • Expense incurred by it in relation to the joint venture. 3. Jointly controlled entities: In its separate

- 8. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP financial statements venturer to recognize as an investment, its interest in the Joint Venture. In consolidated financial statements venturer to report its interest in the jointly controlled entity using proportionate consolidation method. Foreign Currency Translation Individual company Translate at rate on date of Similar to IAS. Similar to IAS. Similar to IAS. transaction; monetary assets/liabilities at balance sheet rate; non-monetary items at historical rate. Foreign entities within Use closing rate for balance Similar to IAS. Similar to IAS, but can use Even though consolidation of consolidated financial sheets; average rate for income closing rate for income Foreign subsidiaries is required statements statements. Take exchange statements. Recognise the accounting treatment has differences to equity and exchange differences in the not been specifically include in gain on disposal of Statement of Recognized Gains addressed. subsidiary. and Losses. However, taking into account the accounting treatment suggested by other Standards the closing rate may be used for balance sheets and average rates may be used for income statements with the difference being accounted for in the income statement of the parent company.

- 9. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP Combinations Purchase method - fair Fair value assets and liabilities Similar to IAS, but specific rules for Similar to IAS. Assets and liabilities may be values on acquisition of acquired entity. acquired in-process research and incorporated at their existing development (generally expensed). carrying amounts, or Some liabilities relating to the alternatively the consideration acquired entity may be Similar to IAS, but less stringent Very few acquisition provisions is allocated to individual assets recognised in restricted recognition criteria as regards allowed. and liabilities on the basis of circumstances. timing of implementation of the their fair values. • Liabilities are not recorded plans. No separate acquisition at the date of acquisition if provisions allowed. they result from the acquirer’s intentions or actions. • Acquirer recognises a provision that was not a liability if the acquirer has developed the main features of a plan that involves reducing/terminating activities and that relates to compensating employees of the acquiree.

- 10. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP Purchase method – Fair values can be corrected Similar to IAS, in that there is an Similar to IAS. Subsequent adjustments subsequent adjustments against goodwill up to the end allocated period of up to one year normally not allowed. to fair values of the year after acquisition if following the date of the additional evidence of values acquisition. Adjustments made becomes available. during the allocation period relating to data for which Record subsequent adjustments management was waiting to in income statement. Reversals complete the allocation are of acquisition provisions always recorded against goodwill. Very few acquisition provisions adjust goodwill. allowed. Similar to IAS. Purchase method – Estimated at acquisition then Not recognised until the Similar to IAS Included in consideration if the contingent consideration subsequently corrected against contingency is resolved or the payment is probable and a goodwill. amount is determinable. reasonable estimate of the amount can be made. Adjustment is made to goodwill or capital reserve, as applicable. Purchase method – State at share of fair value of Usually state at share of pre- State at share of fair value of State at share of pre- minority interests at net assets or at share of pre- acquisition carrying value of net net assets acquisition carrying value of acquisition acquisition carrying value of net assets. net assets . assets. Purchase method – Disclosures include names and Similar to IAS, plus additional Similar to IAS, but must also Comparable to IAS. Additional disclosure descriptions of combining disclosures regarding the reasons present table showing book disclosures include particulars entities, method of accounting for the acquisition, and details of values, fair value adjustments of the scheme sanctioned for acquisition and date of allocations. Public companies must and fair values of acquired under a statute, consideration acquisition, summary of fair also present proforma income assets and liabilities. and description of the values of assets and liabilities statement information as if consideration paid or acquired and impact on results acquisition occurred at the start of contingently payable, amount and financial position of the comparative period. of goodwill/ capital reserve, acquirer. and the treatment thereof.

- 11. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP Purchase method – Capitalise and amortise over Capitalise but do amortise Goodwill Similar to IAS, although Capitalise and amortise to goodwill useful life, normally not longer should be tested for impairment at indefinite life may be used in income over useful life, than 20 years. least annually at the reporting unit certain circumstances. normally not exceeding 5 level. years. Purchase method – If relates to expected future Reduce proportionately the fair Recognise as negative asset Treat as capital reserve, which negative goodwill losses/costs recognise in values assigned to non-current and recognise in the income is not amortised. income when these occur. assets (with certain exceptions). statement to match Otherwise record as negative Any excess is recognised in the depreciation of non-monetary asset and recognise over useful income statement immediately as assets; any excess over the fair lives of identifiable, non- an extraordinary gain value of such assets is monetary assets. Any excess recognised in the income over the fair values of such statement over period likely to assets is recognised in income benefit. immediately. Pooling of interests Severely restricted to “true Prohibited. Restrictions similar, but not Restricted to amalgamation in method mergers of equals”. Rules focus quite as though as IAS. Criteria the nature of “merger” only. on lack of identification of an include size of entities and low Allowed only when certain acquirer. level limits on non share conditions are met, mainly consideration. when all assets and liabilities, and 90% shareholders of transferor company become part of the transferee company. Intangible assets Capitalise if recognition criteria Capitalise purchased intangible Broadly similar to IAS, although Capitalise intangible assets if met; intangible assets must be assets. may use indefinite life in certain specific criteria are met and amortised over useful life, Goodwill and other intangibles are rare circumstances. amortise over useful life. normally no longer than 20 not presumed to be wasting years. Revaluations are assets. The recoverable amount of an permitted in rare All intangibles that have indefinite intangible asset that is not circumstances. useful life are required to be available for use or is being tested, at least annually, for amortised over a period

- 12. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP impairment. exceeding 10 years should be Intangible assets that have finite reviewed at each year-end. useful life are required to be amortised over their useful lives. Amortisation should be based on the consumption pattern of the asset or on straight line basis if a pattern is not determinable. The amortisation period should be reviewed at each year-end and changed if significantly different from previous estimates. Subsequent expenditure on an intangible asset is recognised as an expense unless it is probable that the expenditure will generate future benefits in excess of originally assessed standards of performance. Internally generated Expense research costs as Expense both research and An entity may choose to Intangible assets arising from intangible assets incurred. Capitalise and development costs as incurred. capitalise internally generated development are recognised if amortise development costs Some software and website assets, other than research and specific criteria are met. only if stringent criteria are development costs must be development expenditure when met. capitalised. a market exists. Expense research costs as incurred. Recognition criteria not as strict as IAS. Internally generated goodwill is not recognised. Main Accounting Principles Property, plant and Use historical cost or revalued Revaluations not permitted. Similar to IAS. Use historical costs or revalued

- 13. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP equipment amounts. Frequent valuations amounts. On revaluation, an of entire classes of assets entire class of assets is necessary when revalued revalued, or selection of assets amounts used. for revaluation is made on a systematic basis. No current restriction on frequency of valuation. Depreciation Allocated on a systematic basis Calculated to match the use of the Rates prescribed in the to each accounting period asset over its useful life. Companies Act for the during the useful life of the minimum depreciation asset. provision. Where applicable, higher depreciation based on useful life of the asset should be provided. Asset lives are not prescribed by the Cos. Act but can be derived from the depreciation rates. Investment properties Measure at depreciated cost or Treat as for other properties (use Carry at open market value Carry at cost. Reduce carrying fair value and recognise historical cost). without depreciation. Changes amount to recognise a decline changes in fair value in the in fair value recognise in the in value other than a income statement. STATEMENT OF RECOGNISED temporary decline. GAINS AND LOSSES. Impairment of assets If impairment indicated, write Impairment review based on Similar to IAS. The institute of chartered down assets to higher of net undiscounted cash flows. If less Accountants of India is selling price and value in use than carrying amount, measure reviewing an exposure draft on based on discounted cash impairment loss using discounted impairment of assets. flows. cash flows. Capitalisation of Permitted for qualifying assets. Compulsory when relates to Similar to IAS. Borrowing costs that are borrowing costs construction of certain qualifying directly attributable to the assets. acquisition, construction or production of a qualifying asset is capitalised as part of

- 14. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP the cost of the asset. Finance leases – Finance lease if substantially all Similar to IAS, but considerably Comparable to IAS. Similar to IAS. classification risks and rewards of ownership more extensive form-driven transferred. Substance over requirements. form is important. Leases – lessee Record finance leases as asset Comparable to IAS. Comparable to IAS. Similar to IAS accounting and obligation for future rentals. Normally depreciate over useful life of asset. Apportion rental payments to give constant interest rate on outstanding obligation. Generally charge operating lease rentals on straight-line basis. Leases-lessor accounting Record amounts due under Comparable to IAS but specific Presentation comparable to IAS Similar to IAS. finance leases as a receivable. rules for leveraged leases. but measurement basis differs: Allocate gross earnings to give use (post tax ) non cash constant rate of return based investment method for on net investment method. allocating gross earnings. Leases – sale and Defer and amortise profit Defer and amortise profits up to Similar to IAS except defer and Similar to IAS. leaseback transactions arising on sale and finance certain limits. Immediately amortise profit over the shorter leaseback. If an operating lease recognise losses. Consider specific of the lease term or useful life. arises then profit recognition strict criteria if a real estate depends on sale proceeds transaction. compared to fair value of the asset. Investments Carry long-term investments at Depends on classification of Carry long term investment at Carry long-term investments at cost or revalued amounts. investment-if held to maturity then cost, market value or other cost (with provision for Record revaluations consistently carry at amortised cost, otherwise appropriate basis, such as net permanent diminution in

- 15. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP in income statement or equity. at fair value. Take unrealised gains asset value. Carry current asset value). Current investments Carry current asset investments / losses to other comprehensive investments at lower of cost carried at lower of cost or fair at lower of cost and market income or (if trading securities) to and net realisable value or at value determined on individual value or at market value. income statement. current cost. basis or by category of Record market value changes in investment but not on overall income statement. Recent (or global) basis. proposals to carry some financial assets at fair value. Inventories and long Carry at lower of cost and net Broadly comparable to IAS – more Comparable to IAS except that Carry at lower of cost and net term contracts realisable value; use FIFO, LIFO common use of LIFO. LIFO method not permitted. realisable value. Cost is or weighted average method to normally determined by FIFO determine cost. or weighted average cost method. Specific identification Recognise long-term contract Use completed contract method method may be used in certain revenues and profits using for long-term contact accounting in cases. percentage of completion limited circumstances. For long-term contracts, either method. percentage completion method or completed contract method may be used. Revenue recognition Recognise revenue if meets Broadly comparable to IAS. No detailed standard on Comparable to IAS. specific criteria. Numerous accounting guidance for revenue recognition but specific industries and situations. practices similar to IAS. Transfers of financial Currently no standard. Recent Recognise and de-recognise assets Recognise and derecognise Recognise/de-recognise based assets proposals to recognise and de- based on control. Strict criteria assets based on risks and on transfer of significant risks recognise assets based on evidencing surrender of control for rewards, focussing in part on and rewards of ownership. control. de-recognition. substance rather than just legal form. Provisions - general Record provisions relating to Separate rules for specific Comparable to IAS. Comparable to IAS. present obligations from past situations (employee termination events if probable outflow of costs, environmental liabilities, resources can be reliably etc.) estimated.

- 16. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP Provisions - restructuring Make restructuring provisions if Similar to IAS, however only need Similar to IAS. Comparable to IAS. detailed formal plan exists and management approval and announced or implementation communication for involuntary begun. employee termination. Contingencies Disclose possible losses and Similar to IAS Similar to IAS. Contingent loss is provided in probable gains. the profit and loss statement if it is probable that future events will confirm that, after taking into account any related probable recovery, an asset has been impaired or a liability has been incurred as at the balance sheet date and a reasonable estimate of the amount of the resulting loss can be made. In other cases, contingent losses are to be disclosed unless the possibility of occurrence is remote. Contingent gains are not recognised. Employee benefits - Must use projected unit credit Broadly comparable to IAS, New standard is similar to IAS If employer chooses to make pension costs – defined method to determine benefit although several minor differences. with some differences. The payment for retirement benefit plans obligation surplus or deficit of the defined benefits out of his own funds benefit obligation over plan provision in the accounts is assets are recognised normally made based on immediately in the STATEMENT actuarial valuation. OF RECOGNISED GAINS AND In case liability is funded LOSSES. through creation of a trust, cost incurred for the year is determined actuarially. Annual contributions are normally based on actuarial valuation.

- 17. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP In case liability is funded through a scheme administered by an insurer, an actuarial certificate or confirmation from the insurer regarding contributions payable is obtained. The financial statements have to disclose the method by which retirement benefit costs for the period have been determined. In case the costs are based on actuarial valuation, the financial statements to disclose the date of actuarial valuation and the method by which the accrual for the period has been determined. Employee benefits - Account for post-retirement Comparable to IAS for post- New standard similar to IAS for Post retirement schemes, other benefits as pensions. Rules also retirement benefits. More detailed post-retirement benefits. Other which are defined benefit given for termination benefits guidance for termination benefits. benefits not covered by schemes, are accounted as and other post-employment and Termination indemnity similar to standards, but practice pensions. long term employee benefits. IAS. generally similar to IAS. For other benefits, Account for termination contributions are reflected in indemnity plans as pensions. the profit and loss statement. Deferred income taxes Use full provision method, Comparable to IAS, but recognise Use full provision method (more Deferred Tax assets and driven by balance sheet all deferred tax assets and then extensive exceptions) based on liabilities should be recognised temporary differences. provide valuation allowance if timing differences between for all timing differences Recognise deferred tax assets if recovery is less than 50% likely. accounting and taxable profit. subject to consideration of recovery is probable. prudence in respect of deferred tax assets.

- 18. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP A number of specific differences in A number of specific differences Unrecognised deferred tax application. in application. assets are reassessed at each balance sheet date and are recognised to the extent that it is certain that such previously unrecognised deferred tax assets will be realised. Deferred tax assets and liabilities are measured using tax rates that have been enacted or substantively enacted by the Balance Sheet date. Derivatives and other Gains / losses on hedges of Similar to IAS, except all hedge Similar to US GAAP. No guidance currently. financial instruments – foreign entity investments ineffectiveness recognised in the measurement of hedges recognised in equity, including income statement. of foreign entity hedge ineffectiveness on non- investments derivatives. For derivatives, recognise hedge ineffectiveness in the Income statement. Gains/losses held in equity must be transferred to the income statement on disposal of investment. Derivatives and other Measure derivatives and hedge Similar to IAS, except no basis No comprehensive guidance No guidance currently. financial instruments – instrument at fair value; adjustment on cash flow hedges of currently. Financial liabilities measurement of recognise changes in fair value future. measured at amortised net derivative instruments in income statement except for proceeds, with gains and losses and hedging activities effective cash flow hedges from premature settlement defer in equity until effect of recognised in the income

- 19. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP the underlying transaction is statement. recognised in the income statement. Gains/losses on hedge instrument used to hedge forecast transaction, included in cost of asset/liability. Related party Determine by level of direct or Similar to IAS. Similar to IAS. Determine by ability to control transactions - definition indirect control and significant or to exercise significant influence of one party over influence over the other party. another, or common control of both parties. Related party Disclose name of related party Similar to IAS. Similar to IAS. Similar to IAS except the transactions - and nature of relationship and following additional disclosures types of transactions. For disclosures: control relationships, give • Volume of transactions disclosures regardless of • Amounts due from related whether transactions occur. parties outstanding at the balance sheet date Some exemptions available for Exemptions are narrower than Exemptions are more widely together with provision for separate financial statements of under IAS. available than under IAS. doubtful debts due from subsidiaries. related parties. • Amounts written off or written back during the period in respect of debts due from related parties. Earnings per share – Use weighted average potential Similar to IAS. Similar to IAS. Comparable to IAS. diluted dilutive shares as denominator for diluted EPS. Use “treasure stock” method for share options / warrants.

- 20. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP Extraordinary and Extraordinary items limited to a Similar to IAS. Gains or loss from Extraordinary items are non Similar to IAS. exceptional items few events outside control of extinguishing debt must be existent. company. Does not use the classified as extraordinary. term, but requires separate Exceptional items are disclosed disclosure of items that are of Exceptional items treatment is by way of note, or where such size and nature that similar to IAS but it is disclosed on necessary to give true and fair requires separate disclosure to the face of the income statement. view, on the face of the income explain the performance of the statement. Classify with related entity. Exceptional items usually line item. shown on the face of the income statement or in the notes. Post balance sheet Adjust financial statements for Similar to IAS. Similar to IAS. Similar to IAS. events subsequent events providing evidence of conditions at balance sheet date and materially affecting amounts in financial statements. Disclose non-adjusting events. Segment reporting - Public entities. Report primary Public entities. Report based on Public and very large private Similar to IAS. scope and basis of and secondary segment formats internal operating segments. entities. Report based on formats based on risks and returns and classes of business and internal reporting structure. geographical areas. Segment reporting - Use group accounting policies. Use internal financial reporting Similar to IAS. Segment information should accounting policies policies (even if accounting policies confirm to accounting policies may differ from consolidated used for preparing financial GAAP). statements of the enterprise as a whole. A detailed calculation for applying an enterprise wide accounting policy may be allocated to segments. Disclosure of additional

- 21. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP segment information prepared on a basis other than enterprise wide accounting policy is permitted. Segment reporting – Disclosures for primary Similar disclosures to IAS, except Disclose revenue results and Additional disclosures with disclosures segment format include sales, liabilities and geographical capex net assets. Equal prominence to respect to depreciation and profits, capex, assets and not required. Depreciation, disclosures by class of business other non cash expenses. liabilities. For secondary amortisation, tax, interest and and geographically. For secondary format sales, segment format, report sales, exceptional / extraordinary items assets and capex to be assets and capex. required if reported internally. disclosed. Other required disclosures include basis of pricing inter segment transfers, types of products and services and composition of each geographical segment. Cash flow statement - Standard headings, but Similar headings to IAS, but more More standard headings than Standard headings, using formats and method flexibility over their contents. specific guidance given for items IAS. Use direct or indirect direct or indirect method, Use direct or indirect method. to include in each. Use direct or method. prescribed for all listed indirect method. companies and companies with turnover in excess of Rs 500 million. Cash flow statements – Cash includes overdrafts and Cash excludes overdrafts but Cash includes overdrafts but Cash includes cash in hand definition of cash and cash equivalents with short- includes cash equivalents with excludes cash equivalents. and deposits repayable on cash equivalents term maturities (less than 3 short-term maturities. demand. Cash equivalents are months). short term, highly liquid investments that are readily convertible to cash (normally 3 months or less). Bank borrowings are generally

- 22. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP considered to be financing activities. Statement of recognised Give statement of recognised Disclose total comprehensive Give primary statement of total Not required. gains and losses gains and losses either as income, either combined with recognised gains and losses separate primary statement or income statement or choose one (STATEMENT OF RECOGNISED separately highlighted in of the two alternatives as for IAS. GAINS AND LOSSES). primary statement of movements in equity. Current proposal for a single performance statement. Interim financial Not mandatory to prepare If issued, the contents of interim Mandatory for listed entities Only an enterprise desirous of reporting interim statements but must statements are prescribed and (half yearly); minimum contents preparing interim financial use standard if do prepare. basis should be consistent with full specified by the London Stock statements is required to Basis should be consistent with year statements. Quarterly Exchange. comply with the statement on full year statements and include reporting also necessary for SEC UK ASB non mandatory interim financial reporting. comparatives. registrants (domestic US statement is similar to IAS. Minimum requirements include enterprises only). balance sheet, P&L a/c and cash flow statement (if applicable) in condensed form. Form and content should confirm to requirements of Annual financial statements. Quarterly interim financial reporting mandatory for listed entities; minimum contents specified by SEBI. Discontinuing/discontinu Make provision for some cost if Accrue at measurement date for Similar to IAS. Assets are stated at lower of ed operations – considered a restructuring and estimated operating loss in wind- net book value and net measurement criteria for recognising a down period and on disposal. realisable value. provision are met. Provide for all foreseeable Carry assets at lower of carrying losses that are probable and Write down assets to higher of amount and net realisable value. measurable. net selling price and value in

- 23. GAAP differences Comparison of GAAP requirements under IAS, US, UK and India SUBJECT IAS US GAAP UK GAAP INDIAN GAAP use based on discounted cash flows. Discontinuing/discontinu Give details of discontinuing Report discontinued operations as Disclose on the face of the Disclose on the face of the ed operations - operation. Disclose (on face of a separate line item on the face of income statement components income statement the pre tax presentation and income statement) pre tax gain the income statement (net of tax of operating profit relating to gain or loss from operations disclosure or loss from discontinuance. and below net income from discontinued operations. and from disposal of assets. continuing operations). Current proposal is for a greater Other disclosures include level of disclosure of details about the discontinued discontinuing operations. operations, the business or geographical segment in which it is reported, the date or period in which discontinuance is expected to be completed and the assets, liabilities, revenues, expenses and cash flows attributable to the discontinued operation. Disclosures begin with the period in which the initial disclosure event occurs.