Income Tax Slabs Fy 2010 11

•Download as DOC, PDF•

0 likes•18,037 views

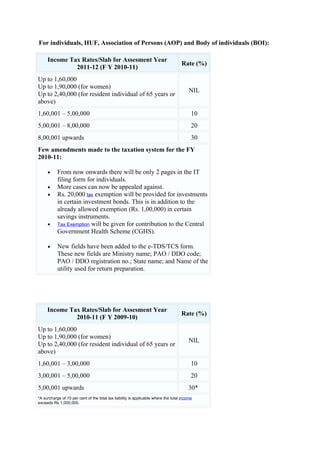

Updated Income Tax Slabs for individuals, HUF, Association of Persons (AOP) and Body of individuals (BOI) for FY 2010-11

Report

Share

Report

Share

Recommended

More Related Content

Viewers also liked

Viewers also liked (9)

Recently uploaded

Article in The Times of Israel by Andy Blumenthal: This is not about free speech but about a takeover of America. These vile terrorist supporters are using our very Constitution against us as they falsely cry Islamophobia and free speech, all the while impeding, threatening, and committing acts of violence against students, citizens, and an orderly democracy. It is time for Americans to stop being complacent or fooled by their terrorist talking points and rhetoric of hate, racism, and Communist ideology. In the face of this evil, we are finally seeing Patriots emerge, proudly carrying and defending the American flag, singing the Star-Spangled Banner, and boldly chanting USA!America Is the Target; Israel Is the Front Line _ Andy Blumenthal _ The Blogs...

America Is the Target; Israel Is the Front Line _ Andy Blumenthal _ The Blogs...Andy (Avraham) Blumenthal

Recently uploaded (20)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 48 (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 48 (Gurgaon)

{Qatar{^🚀^(+971558539980**}})Abortion Pills for Sale in Dubai. .abu dhabi, sh...

{Qatar{^🚀^(+971558539980**}})Abortion Pills for Sale in Dubai. .abu dhabi, sh...

BDSM⚡Call Girls in Greater Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Greater Noida Escorts >༒8448380779 Escort Service

Busty Desi⚡Call Girls in Vasundhara Ghaziabad >༒8448380779 Escort Service

Busty Desi⚡Call Girls in Vasundhara Ghaziabad >༒8448380779 Escort Service

Enjoy Night ≽ 8448380779 ≼ Call Girls In Palam Vihar (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Palam Vihar (Gurgaon)

Verified Love Spells in Little Rock, AR (310) 882-6330 Get My Ex-Lover Back

Verified Love Spells in Little Rock, AR (310) 882-6330 Get My Ex-Lover Back

BDSM⚡Call Girls in Sector 135 Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Sector 135 Noida Escorts >༒8448380779 Escort Service

Julius Randle's Injury Status: Surgery Not Off the Table

Julius Randle's Injury Status: Surgery Not Off the Table

BDSM⚡Call Girls in Indirapuram Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Indirapuram Escorts >༒8448380779 Escort Service

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 47 (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 47 (Gurgaon)

America Is the Target; Israel Is the Front Line _ Andy Blumenthal _ The Blogs...

America Is the Target; Israel Is the Front Line _ Andy Blumenthal _ The Blogs...

BDSM⚡Call Girls in Sector 143 Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Sector 143 Noida Escorts >༒8448380779 Escort Service

Powerful Love Spells in Phoenix, AZ (310) 882-6330 Bring Back Lost Lover

Powerful Love Spells in Phoenix, AZ (310) 882-6330 Bring Back Lost Lover

Income Tax Slabs Fy 2010 11

- 1. For individuals, HUF, Association of Persons (AOP) and Body of individuals (BOI): Income Tax Rates/Slab for Assesment Year Rate (%) 2011-12 (F Y 2010-11) Up to 1,60,000 Up to 1,90,000 (for women) NIL Up to 2,40,000 (for resident individual of 65 years or above) 1,60,001 – 5,00,000 10 5,00,001 – 8,00,000 20 8,00,001 upwards 30 Few amendments made to the taxation system for the FY 2010-11: • From now onwards there will be only 2 pages in the IT filing form for individuals. • More cases can now be appealed against. • Rs. 20,000 tax exemption will be provided for investments in certain investment bonds. This is in addition to the already allowed exemption (Rs. 1,00,000) in certain savings instruments. • Tax Exemption will be given for contribution to the Central Government Health Scheme (CGHS). • New fields have been added to the e-TDS/TCS form. These new fields are Ministry name; PAO / DDO code; PAO / DDO registration no.; State name; and Name of the utility used for return preparation. Income Tax Rates/Slab for Assesment Year Rate (%) 2010-11 (F Y 2009-10) Up to 1,60,000 Up to 1,90,000 (for women) NIL Up to 2,40,000 (for resident individual of 65 years or above) 1,60,001 – 3,00,000 10 3,00,001 – 5,00,000 20 5,00,001 upwards 30* *A surcharge of 10 per cent of the total tax liability is applicable where the total income exceeds Rs 1,000,000.

- 2. Note : - • Education cess is applicable @ 3 per cent on income tax, inclusive of surcharge if there is any. • A marginal relief may be provided to ensure that the additional IT payable, including surcharge, on excess of income over Rs 1,000,000 is limited to an amount by which the income is more than this mentioned amount. • Agricultural income is exempt from income-tax. Thus, now there shall be three slabs – • Rs. 160,001/- to Rs. 500,000/- 10% • Rs. 500,001/- to Rs. 800,000/- 20% • Above Rs. 8 Lacs 30% In a relief to individual tax payers, the government today changed the slabs cutting the rate to 10 per cent for income up to Rs 5 lakh, while leaving the threshold limit for tax-free income unchanged at Rs 1.6 lakh. Income between Rs 5 lakh to Rs 8 lakh will attract 20 per cent tax against the current slab of Rs 3 lakh to Rs 5 lakh. Hitherto, the income between Rs 1.6 lakh and Rs 3 lakh was taxed at the rate of 10 per cent. In case of income over Rs 8 lakh, tax would be levied at a rate of 30 per cent — which was applicable on income above Rs 5 lakh. The tax concessions would put more money in the hands of consumers. Finance Minister Pranab Mukherjee also extended income tax exemption to investment in infrastructure bonds by up to Rs 20,000, over and above the existing limit of Rs 1 lakh. In a major relief to the corporate sector, the government proposed to reduce the surcharge on corporate tax to 7.5 per cent from 10 per cent now. However, it has increased the Minimum Alternate Tax (MAT) from existing 15 per cent to 18 per cent on book profits of those companies which do not pay tax because of various exemptions.